srp

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D. C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___ to ___.

Commission file number

(Exact name of registrant as specified in its charter)

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

The |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

☐ |

|

☒ |

|

Smaller reporting company |

||

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act) ☐ Yes ☒

As of December 31, 2023, the aggregate market value of the issued and outstanding common stock held by non-affiliates of the registrant, based upon the closing price of our common stock of $0.1696 was approximately $

statement only, all directors, named executive officers and 10% shareholders are assumed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

Number of shares of common stock outstanding as of October 7, 2024 was

DOCUMENTS INCORPORATED BY REFERENCE:

Auditor Name:

FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2024

TABLE OF CONTENTS

i

PART I

Item 1. Business.

Background

Kintara Therapeutics, Inc. (“Kintara” or the “Company”) is a clinical stage, biopharmaceutical company focused on the development and commercialization of new cancer therapies.

We are the parent company of Del Mar Pharmaceuticals (B.C.) Ltd. (“Del Mar (BC)”), a British Columbia, Canada corporation, and Adgero Biopharmaceuticals Holdings, Inc., a Delaware Corporation (“Adgero”). We are also the parent company of Kayak Mergeco, Inc., our wholly owned subsidiary incorporated in the State of Delaware (“Kayak Mergeco”) formed to facilitate the proposed merger with TuHURA Biosciences, Inc. (“TuHURA”) as described below. In addition, we are also the parent company to 0959454 B.C. Ltd. (“Callco”) and 0959456 B.C. Ltd. (“Exchangeco”), which are British Columbia, Canada corporations. Callco and Exchangeco were formed to facilitate the reverse acquisition that occurred in 2013.

References to “we,” “us,” and “our” refer to Kintara and our wholly-owned subsidiaries, Del Mar (BC), Adgero, Adgero Bio, Callco, Exchangeco, and Kayak Mergeco.

We are dedicated to the development of novel cancer therapies for patients with unmet medical needs. Our mission is to benefit patients by developing and commercializing anti-cancer therapies for patients whose solid tumors exhibit features that make them resistant to, or unlikely to respond to, currently available therapies, with particular focus on orphan cancer indications.

Our lead candidate is REM-001, a late-stage photodynamic therapy (“PDT”) for the treatment of cutaneous metastatic breast cancer (“CMBC”). PDT is a treatment that uses light sensitive compounds, or photosensitizers, that, when exposed to specific wavelengths of light, act as a catalyst to produce a form of reactive oxygen that induces local tumor cell death.

Corporate Events

2

Upcoming Clinical Milestones (subject to available financing)

Effective July 1, 2023, we were awarded a $2 million grant from the National Institutes of Health (“NIH”) to be received over a two-year period as expenses are incurred. The grant from the NIH will fund the majority of expenses related to the REM-001 Study. As a result of receiving the NIH grant, we re-initiated our REM-001 program and have opened enrollment at Memorial Sloan Kettering Cancer Center, where we have initiated treatment in a total of 4 patients as of October 7, 2024. We expect to complete enrollment of patients in the REM-001 Study in the fourth calendar quarter of 2024.

REM-001

Background

Through REM-001, we are developing our photodynamic therapy (“PDT”) for the treatment of rare, unmet medical needs. PDT is a treatment that uses light sensitive compounds, or photosensitizers, that, when exposed to specific wavelengths of light, act as catalysts to produce a form of oxygen that induces local tumor cell death. REM-001 consists of three parts: the laser light source, the light delivery device, and the REM-001 drug product (collectively, the “REM-001 Therapy”). REM-001 consists of an active pharmaceutical ingredient (“API”) in a lipid formulation. The REM-001 API is SnET2 (“tin ethyl etiopurpurin”) which is a second-generation PDT photosensitizer agent. We believe REM-001 possesses multiple advantages over earlier generation PDT compounds.

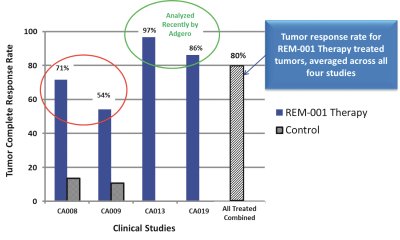

Our lead indication for REM-001 is CMBC which is a disease that may strike individuals with advanced breast cancer and for which effective treatment options are limited. In four Phase 2 and/or Phase 3 clinical studies in CMBC patients, primarily targeting patients who had previously received chemotherapy and failed radiation therapy, REM-001 Therapy was able to reduce, or eliminate, a substantial number of the treated CMBC tumors. Specifically, our analysis of the data collected from these studies indicates that in approximately 80% of evaluable tumor sites treated with REM-001 Therapy, there was a complete response; meaning that follow-up clinical assessments indicated no visible evidence of the tumor remaining. We believe clinical data indicates that REM-001 Therapy holds promise as a treatment to locally eliminate, or slow the growth of, treated cutaneous cancerous tumors in this difficult-to-treat patient population.

Numerous approaches have been utilized to treat CMBC patients, including various forms of chemotherapy, radiation therapy, surgical excision, hyperthermia, cryotherapy, electro-chemotherapy, topical drugs, and intra-lesional chemotherapy injections. However, for the most part, we believe that these therapies are often inadequate given the limited efficacy, toxicities and/or side effects of each. We believe our REM-001 Therapy has several advantages for this indication: it can be highly directed to the tumor site, has minimal systemic effects or normal tissue toxicities, can be used in conjunction with other therapies, and can be periodically repeated.

Our REM-001 Therapy product consists of three parts: the DD series laser light source (or equivalent), the ML2-0400 light delivery device (or equivalent) and the drug REM-001. In use, REM-001 is first administered by intravenous infusion and allowed to distribute within the body and be taken up by the tumors. Tumors are then illuminated with light using the light delivery device, which is attached to the laser light source, so that the accumulated REM-001 can be activated for the desired clinical effect.

As a result of our review of the historical data, we submitted questions to the U.S. Food and Drug Administration (“FDA”) under a Type C format to review the technology and results and determine the anticipated requirements for regulatory approval. On March 3, 2017, we received the FDA’s written response to these questions. Based on that response, we have successfully

3

manufactured REM-001 and developed light delivery devices for our planned 15-patient Phase 2 study. We received a Study May Proceed letter from the FDA for our 15-patient study on August 9, 2022.

On October 19, 2022, we announced that the REM-001 program in CMBC was paused to conserve cash which was then used to support the funding of the GBM AGILE Study. Effective July 1, 2023, we were awarded a two-year $2 million Small Business Innovation Research grant from the National Institutes of Health to support the clinical development of REM-001 for the treatment of CMBC. The grant will be received in tranches of approximately $1.25 million for the period July 1, 2023, to June 30, 2024 ($0.8 million received), and approximately $0.75 million for the period July 1, 2024, to June 30, 2025. As a result of receiving the grant, we re-initiated our REM-001 program and have opened enrollment at Memorial Sloan Kettering Cancer Center, where we have initiated treatment in a total of 4 patients as of October 7, 2024. We expect to complete enrollment of patients in the REM-001 Study in the fourth calendar quarter of 2024.

REM-001 Regulatory Filings

On August 9, 2022, we announced that we received a Study May Proceed letter from the FDA to begin our 15-patient study evaluating REM-001 PDT for the treatment of CMBC. The FDA has granted us Fast Track Designation (“FTD”) for REM-001 in CMBC.

Clinical Development Plans

CMBC

Our plan is to conduct an initial open-label, 15-patient study in CMBC to confirm planned dose and optimized study design followed by a Phase 3 clinical study in CMBC. At this time, we estimate the necessary pivotal study design will be a Phase 3 multi-center study that would enroll CMBC patients who have received prior radiation therapy and chemotherapy.

Our plan is to use new lasers that are functionally equivalent to the lasers used in previous studies. Our laser is a portable solid-state diode laser system that is intended for use in PDT as the source of photoactivation of Rostaporfin for the treatment of subjects with cutaneous cancer lesions. Our laser system consists of the Kintara 665 laser with a fiber-coupled illuminator. In the case of cutaneous treatment, such as with CMBC, the light delivery device consists of an optical fiber which has a modified end to allow it to deliver a uniform light treatment field to the tumor. We have had clinical light delivery devices built by a contract medical device manufacturer using the previous basic design and tested to the same performance specifications as used previously.

The REM-001 Drug

REM-001 is a light activated photosensitizer drug used in PDT. During light activation, photosensitizer drugs act as a catalyst and absorb light energy which they transfer to surrounding oxygen-containing molecules to create reactive oxygen species (“ROS”). ROS can initiate various biological mechanisms of action:

REM-001 is a second-generation photosensitizer drug designed with the following attributes to overcome several of the shortcomings of earlier, first generation photosensitizer drugs:

4

REM-001 Safety and Toxicology

PDT carries what we believe is an inherent safety advantage since it uses photosensitizer compounds that are largely inactive except when they are being illuminated by intense light at specific wavelengths. Nevertheless, drug molecules, including photosensitizer molecules, can carry safety or toxicology risks on their own. REM-001 has previously undergone preclinical and clinical studies throughout its development cycle and has undergone certain tests typically required for FDA drug approval. REM-001 has been safely administered to over 1,100 patients in prior clinical studies. Most significantly, REM-001 has been previously reviewed by the FDA as part of the NDA submitted by Miravant Medical Technologies Inc. (“Miravant”) for the use of REM-001 to treat an aspect of AMD, a non-CMBC indication. Following that review, the FDA granted an approvable letter for REM-001 in an aspect of AMD in 2004, with final approval contingent on, among other things, the successful completion of a Phase 3 study. While not definitive, we believe this letter, along with feedback we received from FDA meetings, indicates that it is unlikely that there will be significant safety or toxicology issues associated with REM-001 that would ultimately prevent marketing approval.

Based on our review of previous clinical data of CMBC studies, pain was the most common treatment-related adverse event experienced by patients in these studies. The second most common safety issue experienced with REM-001 was a transient photosensitivity, meaning extended exposure in bright light and direct sunlight should be avoided. Transient photosensitivity occurs with all photosensitizers to some degree. We believe this issue can be addressed by minimizing one’s exposure to bright light and sunlight for two to four weeks after treatment. In general, the potentially treatment-related adverse events observed in these CMBC studies were expected in nature (pain, edema, skin photosensitivity) and severity, and mostly resolved during the course of the studies.

REM-001 Therapy Target Markets

Our development plan for REM-001 Therapy is focused on the treatment of rare unmet needs in cancer, particularly those where the tumor can be accessed with a light delivery fiber device.

CMBC

While most internal cancers can metastasize to the skin, the internal cancer where this most commonly occurs is breast cancer. Radiotherapy is often used as an adjunctive therapy in breast cancer, in part to help prevent the development of local recurrences including CMBC. However, breast cancer survivors may still develop CMBC lesions, even over a decade after their original cancer treatment. In fact, physicians often watch for cutaneous (skin surface) metastases as a sign of breast cancer recurrence. A 2003 meta-analysis of approximately 20,000 cancer patients found that 24% of metastatic breast cancer patients included in the analysis had developed cutaneous metastases, which was the highest rate of skin metastases of any cancer type. Given that approximately 168,000 women in the U.S. suffer from metastatic breast cancer, we believe the prevalence of CMBC may approach 40,000 in the United States. In many cases of CMBC, surgical excision is not possible, so various standard cancer therapies, particularly radiotherapy or chemotherapy, are the first course of treatment. We believe these therapies are inadequate given the well-known dose limiting toxicities, limited efficacy, and/or side effects of each. We are not aware of any prospective clinical studies that have led to FDA approval of a therapy specifically for the treatment of CMBC and we do not expect any to be approved in the near future.

According to a market assessment from Charles River Associates (2018), there is an estimated market opportunity of approximately $500 million for the treatment of CMBC.

Cutaneous Metastatic Cancers

A meta-analysis has shown that approximately five percent of people with internal (non-melanoma, non-lymphatic, non-leukemic) cancers develop cutaneous metastatic tumors in their skin. Based on an estimated incidence of 1,500,000 such internal cancers in the United States, this means that the incidence of such cutaneous metastases is approximately 75,000 with a substantially higher prevalence given the fact that individuals often live with metastatic cancer for years. Regardless of the primary source of the cancer, these cutaneous metastatic tumors often begin as small skin nodules but, as the cancer spreads, more nodules form and can eventually cover large areas of skin. With progression, the tumor field generally becomes more painful as tumors may grow larger and more numerous, ulcerate, bleed and carry a strong odor. Part of our goal is to treat these cutaneous tumors as early as possible to either cause them to be locally eliminated or to slow their growth sufficiently to reduce their late-stage development.

Basal Cell Carcinoma Nevus Syndrome

In addition to the clinical studies that Miravant conducted with REM-001 Therapy in CMBC, it also generated clinical data for patients with BCCNS who developed extensive basal cell carcinoma. BCCNS is a rare but serious condition that is often characterized by the formation of multiple and recurring cutaneous basal cell carcinoma lesions. According to Cancer.net, as of April 2020, approximately 1 in 40,000 individuals in the U.S. have an underlying genetic condition that causes BCCNS and approximately 90% of these have BCCNS and it has been recognized as an orphan indication by FDA. In a previous Phase 1/2 clinical study (CA001B), 14 patients with BCCNS were enrolled and treated with REM-001 Therapy using the same dosing conditions as were used in the CMBC

5

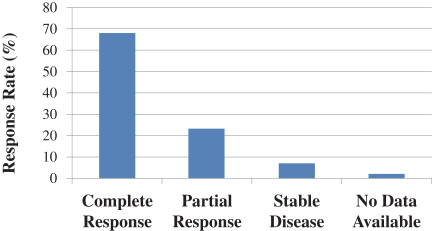

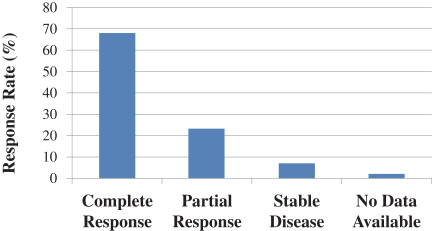

studies. A total of 157 lesions were treated in these patients and showed a 91% overall response rate. This was composed of a 68% complete response rate (no remaining visible evidence of a lesion) and a 23% partial response rate (lesion was reduced in size by more than 50%). In addition, 7% of lesions had stable disease (any increase in lesion size was less than 25%). The various response rates are shown in the graph below and are similar to the results seen in CMBC patients as we would expect. Based on these results we requested, and were granted, an orphan drug designation for SnET2.

Until the FDA approval of the drugs Odomzo (2015) and Erivedge (2012) treatment options for these BCCNS patients were very limited. However, we believe that, based on their package inserts, Odomzo and Erivedge have dose limiting toxicity profiles which are broader in scope than the primarily transient adverse effects observed to-date with REM-001 Therapy. We believe that the potential toxicity limitations related to the existing therapies for BCCNS, plus the positive initial Phase 1/2 data generated in clinical studies with REM-001 Therapy, suggest that REM-001 Therapy could be a viable alternative in treating recurrent basal cell carcinoma in BCCNS patients.

Current and Experimental Treatments for CMBC

As with many cancers, the current standard treatment for CMBC is surgical excision. However, this is often not feasible due to the extent of the tumor field or the condition of the skin, particularly in patients who have had radiation therapy. A number of other therapies have been used on patients with CMBC, including various forms of chemotherapy, radiation therapy, hyperthermia, cryotherapy, electro-chemotherapy, topical drugs and intra-lesional chemotherapy injections. Researchers have also attempted to combine therapies in an effort to improve efficacy. However, we believe that these therapies are often inadequate given the limited efficacy, toxicities and/or side effects of each. The side effects associated with therapies may be particularly difficult for patients who may have already experienced extensive surgery along with a full course of radiation and/or systemic chemotherapy. Also, the fact that CMBC tumors continue to develop following these therapies is a signal that the tumor cells may have developed a resistance to some of these approaches. Based on our discussions with clinicians and literature reviews, and the March 3, 2017, response from FDA, we believe that treatment of unresectable CMBC tumors is a largely unmet medical need, particularly in patients who have already received extensive radiation and chemotherapy.

Clinical Results in CMBC

While we have not conducted any clinical studies, we have undertaken an analysis of the Phase 1 and four Phase 2 and/or Phase 3 CMBC clinical studies done previously with REM-001 Therapy by Miravant. We have concluded that in these studies REM-001 Therapy provided higher tumor response rates than are generally seen with alternative CMBC treatments. However, this program was discontinued in 1998. Our review of clinical records further indicates that following this decision, Miravant continued to monitor patients in the CMBC studies and collected data as required by protocol, but they conducted no further treatment of CMBC patients with REM-001 Therapy. We believe that Miravant primarily chose to discontinue this program in order to focus its REM-001 development efforts on an aspect of “wet” AMD.

6

Phase 2/3 Studies

After completion of the Phase 1 dose finding study, four Phase 2/3 studies were conducted with REM-001 Therapy for the treatment of CMBC as summarized below. These studies all used the same dosimetry as described above and most of the patients had been previously treated with radiation therapy and chemotherapy. The light delivery devices used in these studies were the ML1-0400 or the functionally equivalent ML2-0400. The laser light source used in three of the studies was the Miravant DD2 laser and one study used the KTP model laser manufactured by LaserScope. Each study was conducted under the cancer IND using Good Clinical Practices with safety and efficacy data collected accordingly. In connection with our acquisition of the Miravant assets, ownership of that IND has been transferred to us.

The table below summarizes the CMBC Studies. Studies CA008, CA009 and CA019 required that the patients enrolled had received prior radiation therapy. Study CA013 did not have this specific inclusion requirement but our review of the data indicates that at least 50 of the 56 patients in CA013 had received prior radiation therapy. A second difference across the studies is that studies CA008, CA009 and CA019 had a 24-week follow-up period while study CA013 had a 52-week follow-up period. Also, in studies CA008 and CA009 two tumor lesions on each patient were randomly selected as controls and did not receive light activation. CA013 was conducted in Europe by a corporate partner of Miravant. Beyond these differences and those device differences noted above, we believe there were no other substantive differences between the studies and that all studies enrolled similar patients.

Table of Phase 2 and/or 3 CMBC Studies

(Note: SnET2 is now called REM-001)

Trial Title |

|

Phase |

|

|

Location |

|

Total |

|

|

Total |

|

|

Included |

|||

CA008: Open-Label Randomized No Treatment |

|

2/3 |

|

|

U.S. |

|

|

32 |

|

|

|

32 |

|

|

Yes |

|

CA009: Open-Label Randomized No Treatment |

|

2/3 |

|

|

U.S. |

|

|

36 |

|

|

|

36 |

|

|

Yes |

|

CA013: Multinational, Open-Label Study of Single Dose |

|

|

2 |

|

|

Europe |

|

|

56 |

|

|

|

50 |

|

|

No |

CA019: Open-Label Study of Single Dose Tin Ethyl |

|

|

3 |

|

|

U.S. |

|

|

25 |

|

|

|

25 |

|

|

No |

7

The primary endpoints for studies CA008 and CA009 were objective tumor response rate, quality-of-life change, device performance and patient safety. Our review of the tumor response rate and quality-of-life endpoints indicated they were defined as follows:

No significant device failures were observed in either study. Secondary endpoints in CA008 and CA009 were patient disease burden, duration of response and patient pain assessment. Previous analysis indicated, for patients for which data was available, there was a treatment benefit in disease burden (p = 0.0017 for CA008, p = 0.0020 for CA009) and duration of response (p < 0.001 for CA008, not significant in CA009) when comparing treated and control lesions. In terms of pain, there was no significant change in pain in CA008 and a treatment related increase in pain at 4 Weeks post-treatment in CA009. Treatment related pain, particularly during the first month after treatment, was the most commonly reported adverse event and was often treated with analgesics.

Studies CA013 and CA019 used similar endpoints with one notable exception. Tumor Response as Measured by Paired Response was not possible in these studies since this measurement relies on control lesions and CA013 and CA019 did not include controls. Miravant did not conduct an efficacy analysis of these two studies but we have conducted an analysis of the Quality of Life and Clinical Success endpoints used in the pivotal CA008 and CA009 studies. Results from that analysis are shown in the following table:

|

|

Clinical Success |

|

24 Week Quality of Life Change |

|

|||||||||||||||

Study |

|

Eligible |

|

|

Average |

|

|

95% |

|

Eligible |

|

|

Mean ± SD |

|

P value |

|

||||

CA013 |

|

|

32 |

|

|

|

88 |

% |

|

71% - 97% |

|

|

16 |

|

|

1.3 ± 3.6 |

|

|

1.00 |

|

CA019 |

|

|

18 |

|

|

|

83 |

% |

|

45% - 86% |

|

|

11 |

|

|

2.5 ± 4.7 |

|

|

1.00 |

|

The most common adverse events seen in these four studies (CA008, CA009, CA013, CA019) were pain and photosensitivity, both of which are expected with this therapy. In the four studies there were a total of 17 SAEs that were judged by investigators to be possibly, probably or definitely related to treatment. None of these were classified by the investigator as life threatening and none resulted in death. Of these 17 SAE’s, eight were related to necrosis of the treated lesions, three were related to treatment field infection, four were treatment related pain, one was a photosensitivity skin reaction and one was an allergic reaction.

We believe that the data from these studies show that REM-001 Treatment is a promising therapy for CMBC. However, because there are no approved therapies for CMBC, we have no basis for comparing these results to existing therapies. Based on the FDA’s March 3, 2017 response, we believe the FDA will view these results as supportive data and our plan is to conduct a new pivotal Phase 3 study to support a new drug application.

8

The figure below shows the results of this initial preliminary analysis of the clinical data and depicts the percentage of evaluable lesions in each CMBC Study for which there was a complete response (i.e., where all visible clinical evidence of the tumor is gone after treatment with REM-001 Therapy).

VAL-083

On October 31, 2023, we announced preliminary topline results for VAL-083 from the GBM AGILE study. VAL-083 did not perform better than the current standards of care in glioblastoma and the preliminary safety data was similar to that of the current standards of care used to treat glioblastoma. As a result, we terminated the development of VAL-083. On February 13, 2024, we sent an Opt-Out Notice to Valent Technologies, LLC (“Valent”) under the Valent Assignment Agreement whereby we assigned all rights, title, and interest in and to the patents for VAL-083 to Valent. As a result, we granted Valent a non-exclusive, fully-paid, royalty-free, perpetual, worldwide and non-transferable license, subject to limited exceptions. We are entitled to receive royalties from Valent’s subsequent commercialization of VAL-083 equal to 5% of Valent Net Sales (as defined in the Valent Assignment Agreement).

Manufacturing

REM-001

The manufacturing process for the API in REM-001 was developed over a ten-year period and we believe is now well established and suitable for commercial scale production. This process was also included as part of Miravant’s prior NDA for the use of REM-001 to treat an aspect of AMD, which underwent an FDA review where an approvable letter was granted. The final REM-001 drug product is a lipid-based formulation and was previously produced at a commercial scale by a contract manufacturer for use in Miravant’s previous clinical studies and commercialization activities. We do not own or operate manufacturing facilities for the production of REM-001, nor the laser light source, or light delivery device for use with REM-001 Therapy. We are dependent on third-party suppliers and manufacturing organizations for both commercial and clinical study supplies of all of our raw materials, the REM-001 drug substance, drug product and the REM-001 Therapy, laser light source, and light delivery device.

We have engaged a contract manufacturer who has manufactured the starting material for our API, and then manufactured two API lots under GMP. Stability testing of the API lots is ongoing. We have also engaged a contract manufacturer who has manufactured a drug product lot under GMP for use in our planned 15-patient clinical study. With the feedback from the FDA that we could utilize the existing supply of laser systems or devices that were functionally equivalent, an in-depth assessment was made to determine which pathway would be appropriate. It has been determined that the existing lasers that were utilized in the previous clinical studies will not be used in the current clinical studies. We engaged a third-party contract medical device manufacturer who has built new lasers and light-delivery devices. We have also engaged an affiliate of this manufacturer to train the clinical staff in the use of the units, provide regulatory support for the devices, and maintain the devices while being used in the study. We believe there are readily available supplies of all raw materials needed for the manufacture of REM-001 and the related required light device components to satisfy future requirements.

St. Cloud Asset Purchase Agreement

Adgero acquired certain Miravant assets, including the REM-001 Therapy and the associated technology and intellectual property, through an Asset Purchase Agreement with St. Cloud Investments, LLC (“St. Cloud”), dated November 26, 2012, as amended (the “St. Cloud Agreement”). In conjunction with the merger with Adgero which closed on August 19, 2020, we assumed the

9

St. Cloud Agreement. St. Cloud was previously a Miravant creditor and acquired these Miravant assets pursuant to a foreclosure process St. Cloud completed under California law. Pursuant to the terms of the St. Cloud Agreement, we are obligated to make certain payments under the agreement.

As of June 30, 2024, the amounts still to be paid or owed under that agreement are as follows:

With respect to the $300,000 and $700,000 potential milestone payments referenced above (each a “Milestone Payment”), if either such Milestone Payment becomes payable, and in the event we elect to pay either such Milestone Payment in shares of our common stock, the value of the common stock will equal the price per share of the most recent financing, or, if we are considered to be a publicly-traded company, the average of the closing price per share of our common stock over the twenty (20) trading days following the first public announcement of the applicable event described above.

In addition, we must pay to St. Cloud and Steven Rychnovsky, PhD, in the aggregate, a royalty fee of six percent (6%) of net sales during the royalty term on a country-by-country and product-by-product basis with St. Cloud receiving a royalty rate of four and eight tenths percent (4.8%) and Steven Rychnovsky, PhD, receiving a royalty of one and two tenths percent (1.2%). The royalty term for a product commences on the first commercial sale of the product, such as REM-001 Therapy, in any country, and the royalty fee must be paid within 30 days of each calendar quarter during which revenue is collected. The royalty term terminates on the later of (i) the invalidation, revocation, lapse or expiration of the last to expire valid claim on any patent acquired in the St. Cloud Agreement that would be infringed by the sale of the product in the country where the commercial sale takes place or (ii) the expiration of the period for which we hold exclusive marketing rights of the product in the country, if we were granted those rights under the St. Cloud Agreement.

Patents and Proprietary Rights

Our success will depend in part on our ability to protect our existing product candidates and the products we acquire or license by obtaining and maintaining a strong proprietary position. To develop and maintain our position, we intend to continue relying upon the validity and enforceability of our patents patent protection, orphan drug status, Hatch-Waxman exclusivity, trade secrets, know-how, continuing technological innovations and licensing opportunities.

There is no guarantee that patents will be granted with respect to any patent applications we may submit, own or license in the future, nor can we be sure that any of our existing patents or any patents we may own or license in the future will be useful in protecting our technology.

REM-001

Our product pipeline for REM-001 is based on technology that was originally developed by Miravant. We acquired this technology, which includes scientific and regulatory data and product know-how, through the St. Cloud Agreement. We rely on trade secret protection for our confidential and proprietary information related to REM-001 and have filed patent applications to protect our intellectual property.

Our patent applications for REM-001 can be summarized as follows:

Patent or Patent Application No. |

|

Title |

|

Expiry |

United States Patent Application Serial No. 17/614,132 |

|

Methods for the production of Nickel (II) Etioporphyrin-I. |

|

|

PCT Patent Application Serial No. |

|

Methods for the production of Nickel (II) Etioporphyrin-I. National phase applications pending in various countries. |

|

2041 |

10

Patent or Patent Application No. |

|

Title |

|

Expiry |

United States Patent Application Serial No. 17/546,715 |

|

Methods for treating cutaneous metastatic cancers. |

|

|

PCT Patent Application Serial No. |

|

Methods for treating cutaneous metastatic cancers. National phase applications pending in various countries. |

|

2041 |

We own proprietary regulatory data for REM-001 which includes two INDs for use of REM-001 in oncology and ophthalmology, and one NDA for use of REM-001 to treat age-related macular degeneration ("AMD"). The FDA granted our request that tin ethyl etiopurpurin (the active pharmaceutical ingredient in REM-001) be designated as an orphan drug for treatment of basal cell carcinoma nevus syndrome ("BCCNS"). We also hold an orphan drug designation that was initially awarded to Miravant for tin ethyl etiopurpurin for the prevention of access graft disease in hemodialysis patients.

Government Regulation and Product Approval

Regulation by governmental authorities in the U.S. and other countries is a significant factor, affecting the cost and time of our research and product development activities, and will be a significant factor in the manufacture and marketing of any approved products. Our product candidates will require regulatory approval by governmental agencies prior to commercialization. In particular, our products are subject to rigorous preclinical and clinical testing and other approval requirements by the FDA and similar regulatory authorities in other countries. Various statutes and regulations also govern or influence the manufacturing, safety, reporting, labeling, transport and storage, record keeping and marketing of our products. The lengthy process of seeking these approvals, and the subsequent compliance with applicable statutes and regulations, require the expenditure of substantial resources. Any failure by us to obtain, or any delay in obtaining, the necessary regulatory approvals could harm our business.

The regulatory requirements relating to the testing, manufacturing and marketing of our products may change from time to time and this may impact our ability to conduct clinical studies and the ability of independent investigators to conduct their own research with support from us.

The clinical development, manufacturing and marketing of our products are subject to regulation by various authorities in the U.S., the E.U. and other countries, including, in the U.S., the FDA, in Canada, Health Canada, and, in the E.U., the EMA. The Federal Food, Drug, and Cosmetic Act, the Public Health Service Act in the U.S. and numerous directives, regulations, local laws and guidelines in Canada and the E.U. govern the testing, manufacture, safety, efficacy, labeling, storage, record keeping, approval, advertising and promotion of our products. Product development and approval within these regulatory frameworks takes a number of years and involves the expenditure of substantial resources.

Regulatory approval will be required in all the major markets in which we seek to develop our products. At a minimum, approval requires the generation and evaluation of data relating to the quality, safety, and efficacy of an investigational product for its proposed use. The specific types of data required and the regulations relating to this data will differ depending on the territory, the drug involved, the proposed indication and the stage of development.

In general, new chemical entities are tested in animals until adequate evidence of safety is established to support the proposed clinical study protocol designs. Clinical studies for new products are typically conducted in three sequential phases that may overlap. In Phase 1, the initial introduction of the pharmaceutical into either healthy human volunteers or patients with the disease (20 to 50 subjects), the emphasis is on testing for safety (adverse effects), dosage tolerance, metabolism, distribution, excretion and clinical pharmacology. Phase 2 involves studies in a limited patient population (50 to 200 patients) to determine the initial efficacy of the pharmaceutical for specific targeted indications, to determine dosage tolerance and optimal dosage and to identify possible adverse side effects and safety risks. Once a compound shows preliminary evidence of some effectiveness and is found to have an acceptable safety profile in Phase 2 evaluations, Phase 3 studies are undertaken to more fully evaluate clinical outcomes in a larger patient population in adequate and well-controlled studies designed to yield statistically sufficient clinical data to demonstrate efficacy and safety.

11

In the U.S., specific preclinical data, manufacturing and chemical data, as described above, need to be submitted to the FDA as part of an IND application, which, unless the FDA objects, will become effective 30 days following receipt by the FDA. Phase 1 studies in human volunteers may commence only after the application becomes effective. Prior regulatory approval for human healthy volunteer studies is also required in member states of the E.U. Currently, in each member state of the E.U., following successful completion of Phase 1 studies, data are submitted in summarized format to the applicable regulatory authority in the member state in respect of applications for the conduct of later Phase 2 studies. The regulatory authorities in the E.U. typically have between one and three months in which to raise any objections to the proposed study, and they often have the right to extend this review period at their discretion. In the U.S., following completion of Phase 1 studies, further submissions to regulatory authorities are necessary in relation to Phase 2 and 3 studies to update the existing IND.

Authorities may require additional data before allowing the studies to commence and could demand that the studies be discontinued at any time if there are significant safety issues. In addition to the regulatory review, studies involving human subjects must be approved by an independent body. The exact composition and responsibilities of this body will differ from country to country. In the U.S., for example, each study will be conducted under the auspices of an independent institutional review board (“IRB”) at each institution at which the study is conducted. The IRB considers among other things, the design of the study, ethical factors, the privacy of protected health information as defined under the Health Insurance Portability and Accountability Act, the safety of the human subjects and the possible liability risk for the institution. Equivalent rules to protect subjects’ rights and welfare apply in each member state of the E.U. where one or more independent ethics committees, which typically operate similarly to an IRB, will review the ethics of conducting the proposed research. Other regulatory authorities around the rest of the world have slightly differing requirements involving both the execution of clinical studies and the import/export of pharmaceutical products. It is our responsibility to ensure we conduct our business in accordance with the regulations of each relevant territory.

In order to gain marketing approval, we must submit a dossier to the relevant authority for review, which is known in the U.S. as an NDA and in the E.U. as a marketing authorization application (“MAA”). The format is usually specific and laid out by each authority, although in general it will include information on the quality of the chemistry, manufacturing and pharmaceutical aspects of the product as well as the nonclinical and clinical data. Once the submitted NDA is accepted for filing by the FDA, it undertakes the review process that currently takes on average 10 months, unless an expedited priority review is granted which takes six months to complete. Approval can take several months to several years, if multiple 10-month review cycles are needed before final approval is obtained, if at all.

The approval process can be affected by a number of factors. The NDA may require additional preclinical, manufacturing data or clinical studies which may be requested at the end of the 10-month NDA review cycle, thereby delaying approval until additional data are submitted and may involve substantial unbudgeted costs.

In addition to obtaining approval for each product, in many cases each drug manufacturing facility must be approved. The regulatory authorities usually will conduct an inspection of relevant manufacturing facilities, and review manufacturing procedures, operating systems and personnel qualifications. Further inspections may occur over the life of the product. An inspection of the clinical investigation sites by a competent authority may be required as part of the regulatory approval procedure. As a condition of marketing approval, the regulatory agency may require post-marketing surveillance to monitor for adverse effects or other additional studies as deemed appropriate. After approval for the initial indication, further clinical studies may be necessary to gain approval for any additional indications. The terms of any approval, including labeling content, may be more restrictive than expected and could affect the marketability of a product.

The FDA offers a number of regulatory mechanisms that provide expedited or accelerated approval procedures for selected drugs in the indications on which we are focusing our efforts. These include accelerated approval under Subpart H of the agency’s NDA approval regulations, fast track drug development procedures, breakthrough drug designation and priority review. At this time, we have not determined whether any of these approval procedures will apply to our current drug candidates.

By leveraging existing preclinical and clinical safety and efficacy data, we seek to build upon an existing knowledge base to accelerate our research. In addition, through our focus on end-stage population which has no current treatment options, regulatory approval for commercialization may sometimes be achieved in an accelerated manner. Accelerated approval by the FDA in this category may be granted on objective response rates and duration of responses rather than demonstration of survival benefit. As a result, studies of drugs to treat end-stage refractory cancer indications have historically involved fewer patients and generally have been faster to complete than studies of drugs for other indications. We are aware that the FDA and other similar agencies are regularly reviewing the use of objective endpoints for commercial approval and that policy changes may impact the size of studies required for approval, timelines and expenditures significantly.

12

The U.S., E.U. and other jurisdictions may grant orphan drug designation to drugs intended to treat a “rare disease or condition,” which, in the U.S., is generally a disease or condition that affects no more than 200,000 individuals. In the E.U., orphan drug designation can be granted if: the disease is life threatening or chronically debilitating and affects no more than 50 in 100,000 persons in the E.U.; without incentive, it is unlikely that the drug would generate sufficient return to justify the necessary investment; and no satisfactory method of treatment for the condition exists or, if it does, the new drug will provide a significant benefit to those affected by the condition. If a product that has an orphan drug designation subsequently receives the first regulatory approval for the indication for which it has such designation, the product is entitled to orphan exclusivity, meaning that the applicable regulatory authority may not approve any other applications to market the same drug for the same indication, except in very limited circumstances, for a period of seven years in the U.S. and 10 years in the E.U. Orphan drug designation does not prevent competitors from developing or marketing different drugs for the same indication or the same drug for different indications. Orphan drug designation must be requested before submitting an NDA or MAA. After orphan drug designation is granted, the identity of the therapeutic agent and its potential orphan use are publicly disclosed. Orphan drug designation does not convey an advantage in, or shorten the duration of, the review and approval process. However, this designation provides an exemption from marketing and authorization fees charged to NDA sponsors under the Prescription Drug Act.

Maintaining substantial compliance with appropriate federal, state and local statutes and regulations requires the expenditure of substantial time and financial resources. Drug manufacturers are required to register their establishments with the FDA and certain state agencies, and after approval, the FDA and these state agencies conduct periodic unannounced inspections to ensure continued compliance with ongoing regulatory requirements, including cGMPs. In addition, after approval, some types of changes to the approved product, such as adding new indications, manufacturing changes and additional labeling claims, are subject to further FDA review and approval. The FDA may require post-approval testing and surveillance programs to monitor safety and the effectiveness of approved products that have been commercialized. Any drug products manufactured or distributed by us pursuant to FDA approvals are subject to continuing regulation by the FDA, including:

In addition, the FDA strictly regulates labeling, advertising, promotion and other types of information on products that are placed on the market. There are numerous regulations and policies that govern various means for disseminating information to health-care professionals as well as consumers, including to industry sponsored scientific and educational activities, information provided to the media and information provided over the Internet. Drugs may be promoted only for the approved indications and in accordance with the provisions of the approved label.

The FDA has very broad enforcement authority and the failure to comply with applicable regulatory requirements can result in administrative or judicial sanctions being imposed on us or on the manufacturers and distributors of our approved products, including warning letters, refusals of government contracts, clinical holds, civil penalties, injunctions, restitution and disgorgement of profits, recall or seizure of products, total or partial suspension of production or distribution, withdrawal of approvals, refusal to approve pending applications, and criminal prosecution resulting in fines and incarceration. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant liability. In addition, even after regulatory approval is obtained, later discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market.

Sales of our product candidates, if approved, will depend, in part, on the extent to which such products will be covered by third-party payors, such as government health care programs, commercial insurance and managed healthcare organizations. These third-party payors are increasingly limiting coverage or reducing reimbursements for medical products and services. In addition, the U.S. government, state legislatures and foreign governments have continued implementing cost-containment programs, including price controls, restrictions on reimbursement and requirements for substitution of generic products. Third-party payors decide which therapies they will pay for and establish reimbursement levels. Third-party payors often rely upon Medicare coverage policy and payment limitations in setting their own coverage and reimbursement policies. However, decisions regarding the extent of coverage and amount of reimbursement to be provided for any drug candidates that we develop will be made on a payor-by-payor basis. Each payor determines whether or not it will provide coverage for a therapy, what amount it will pay the manufacturer for the therapy, and on what tier of its formulary it will be placed. The position on a payor’s list of covered drugs, or formulary, generally determines the co-payment that a patient will need to make to obtain the therapy and can strongly influence the adoption of such therapy by patients and physicians. Adoption of price controls and cost-containment measures, and adoption of more restrictive policies in jurisdictions

13

with existing controls and measures, could further limit our net revenue and results. Decreases in third-party reimbursement for our product candidates or a decision by a third-party payor to not cover our product candidates could reduce physician usage of our product candidates, once approved, and have a material adverse effect on our sales, results of operations and financial condition.

Because of our current and future arrangements with healthcare professionals, principal investigators, consultants, customers and third-party payors, we will also be subject to healthcare regulation and enforcement by the federal government and the states and foreign governments in which we will conduct our business, including our clinical research, proposed sales, marketing and educational programs. Failure to comply with these laws, where applicable, can result in the imposition of significant civil penalties, criminal penalties, or both. The U.S. laws that may affect our ability to operate, among others, include: the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act, which governs the conduct of certain electronic healthcare transactions and protects the security and privacy of protected health information; certain state laws governing the privacy and security of health information in certain circumstances, some of which are more stringent than HIPAA and many of which differ from each other in significant ways and may not have the same effect, thus complicating compliance efforts; the federal healthcare programs’ Anti-Kickback Statute, which prohibits, among other things, persons from knowingly and willfully soliciting, receiving, offering or paying remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual for, or the purchase, order or recommendation of, any good or service for which payment may be made under federal healthcare programs such as the Medicare and Medicaid programs; federal false claims laws which prohibit, among other things, individuals or entities from knowingly presenting, or causing to be presented, claims for payment from Medicare, Medicaid, or other third-party payors that are false or fraudulent; federal criminal laws that prohibit executing a scheme to defraud any healthcare benefit program or making false statements relating to healthcare matters; the Physician Payments Sunshine Act, which requires manufacturers of drugs, devices, biologics, and medical supplies to report annually to the U.S. Department of Health and Human Services information related to payments and other transfers of value to physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors) and teaching hospitals, and ownership and investment interests held by physicians and their immediate family members; and state law equivalents of each of the above federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers.

In addition, many states have similar laws and regulations, such as anti-kickback and false claims laws that may be broader in scope and may apply regardless of payor, in addition to items and services reimbursed under Medicaid and other state programs. Additionally, to the extent that our product is sold in a foreign country, we may be subject to similar foreign laws.

We are also subject to numerous environmental and safety laws and regulations, including those governing the use and disposal of hazardous materials. The cost of compliance with and any violation of these regulations could have a material adverse effect on our business and results of operations. Although we believe that our safety procedures for handling and disposing of these materials comply with the standards prescribed by state and federal regulations, accidental contamination or injury from these materials may occur. Compliance with laws and regulations relating to the protection of the environment has not had a material effect on our capital expenditures or our competitive position. However, we are not able to predict the extent of government regulation, and the cost and effect thereof on our competitive position, which might result from any legislative or administrative action pertaining to environmental or safety matters.

Competition

The development and commercialization of new drug products is highly competitive. We expect that we will face significant competition from major pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide with respect to REM-001 and any other product candidates that we may seek to develop or commercialize in the future. Specifically, due to the large unmet medical need, global demographics and relatively attractive reimbursement dynamics, the oncology market is fiercely competitive and there are a number of large pharmaceutical and biotechnology companies that currently market and sell products or are pursuing the development of product candidates for the treatment of cancer. Our competitors may succeed in developing, acquiring or licensing technologies and drug products that are more effective, have fewer or more tolerable side effects or are less costly than any product candidates that we are currently developing or that we may develop, which could render our product candidates obsolete and noncompetitive.

All of the top ten global pharmaceutical companies, and many of the mid-size pharmaceutical companies, have a strong research and development and commercial presence in oncology and there are thousands of smaller companies who also focus on oncology and the oncology supportive care space.

We are not aware of any therapies specifically approved for CMBC in the U.S. IGEA Medical S.p.A. and Mirai Medical market electroporation devices outside the U.S. that are intended to enhance local delivery of chemotherapy agents to tumors. These are sometimes used in CMBC tumors outside the U.S. but we are not aware of any active efforts for U.S. approval in CMBC or similar conditions. Pinnacle Biologics Inc., a subsidiary of Advanz Pharma Healthcare Corp., sells Photofrin, a first-generation PDT product for treatment of certain endobronchial non-small-cell lung cancers and esophageal cancers. Photofrin is currently in Phase 2 studies in recurrent glioma. To our knowledge, there is no reported development program for Photofrin in CMBC. Rogers Sciences Inc. is a medical device company that is developing a light delivery device for use with PDT treatment of cutaneous cancers that they are currently clinically testing in a Phase 2 study in CMBC patients.

14

There are numerous therapies currently used to treat CMBC patients including chemotherapy, radiation therapy, surgical excision, hyperthermia, cryotherapy, electro-chemotherapy, topical drugs and intra-lesional chemotherapy injections, but, to our knowledge, there are no PDT therapies currently approved by the FDA for the treatment of CMBC or similar cutaneous cancers. Some topical PDT agents have been approved by the FDA for actinic keratosis which is a precancerous skin condition and they have been approved in some other countries for some conditions that we believe pose low medical risk such as basal cell cancer and acne.

In the BCCNS field we are aware of approved drugs in the U.S., including vismodegib (Eviredge), Odomzo (sonidegib), imiquimod and topical fluorouracil that are sometimes use off-label. PellePharm also recently completed a Phase 3 study in BCCNS but, to our knowledge, has not received marketing approval.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than any products that we may develop. Our competitors also may obtain FDA or other marketing approval for their products before we are able to obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

Many of our existing and potential future competitors have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical studies, obtaining marketing approvals and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller, or early stage, companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical study sites and patient registration for clinical studies, as well as in acquiring technologies complementary to, or necessary for, our programs.

We expect that our ability to compete effectively will depend upon our ability to:

Failure to do one or more of these activities could have an adverse effect on our business, financial condition or results of operations.

Merger Agreement

On April 2, 2024, we entered into the Merger Agreement with Kayak Mergeco and TuHURA pursuant to which Merger Sub will merge with and into TuHURA, with TuHURA surviving the Merger and becoming our direct, wholly-owned subsidiary. Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), (i) each then-outstanding share of TuHURA common stock, par value $0.001 per share (the “TuHURA Common Stock”) (other than any shares held in treasury and Dissenting Shares (as defined in the Merger Agreement)) will be converted into shares of our common stock equal to the Exchange Ratio, as such term is defined in the Merger Agreement, (ii) each then-outstanding TuHURA stock option will be assumed and converted into an option to purchase shares of our common stock, subject to certain adjustments as set forth in the Merger Agreement, and (iii) each then-outstanding warrant to purchase shares of TuHURA Common Stock (the “TuHURA Warrants”) will be assumed and converted into and exchangeable for a warrant of like tenor entitling the holder to purchase shares of our common stock, subject to certain adjustments as set forth in the Merger Agreement. In addition to the foregoing, the Merger Agreement provides that, at the closing of the Merger (the “Closing”), our corporate name will be changed to “TuHURA Biosciences, Inc.” Our existing stockholders will receive CVRs, entitling them to receive shares of our common stock upon achievement of enrollment of a minimum of 10 patients in the REM-001 Study, with such patients each completing 8 weeks of follow-up on or before December 31, 2025.

Under the terms of the Merger Agreement, on a pro forma basis, our stockholders are expected to collectively own approximately 2.85%, or approximately 5.45% including the shares underlying the CVR, of the common stock of the post-merger combined company on a pro forma fully diluted basis. TuHURA stockholders are expected to collectively own approximately 97.15%,

15

or 94.55% assuming the distribution of the CVR shares, of the common stock of the combined company on a pro forma fully diluted basis.

On October 4, 2024, at the Special Meeting, our stockholders approved the requisite proposals to effect the completion of the proposed Merger with TuHURA. The proposed Merger is expected to be consummated in mid-October 2024, subject to regulatory approval and the satisfaction of the remaining closing conditions under the Merger Agreement.

Corporate History

We are a Nevada corporation formed on June 24, 2009, under the name Berry Only Inc. On January 25, 2013, we entered into and closed an exchange agreement (the “Exchange Agreement”), with Del Mar (BC), Callco, Exchangeco and the security holders of Del Mar (BC). Upon completion of the Exchange Agreement, Del Mar (BC) became a wholly-owned subsidiary of ours (the “Reverse Acquisition”).

On August 19, 2020, we merged with Adgero and changed our name from DelMar Pharmaceuticals, Inc. to Kintara Therapeutics, Inc. We are the parent company to the following entities:

Research and Development

During the years ended June 30, 2024, and 2023, we recognized approximately $2.7 million and $9.3 million, respectively, in research and development expenses.

Employees

We have one full-time employee and retain the services of approximately 10 persons on an independent contractor/consultant and contract-employment basis. As such, we currently operate in a “virtual” corporate structure in order to minimize fixed personnel costs.

Available Information

We maintain an internet website at www.kintara.com. We do not incorporate the information on our website into this report and you should not consider it part of this report.

16

Item 1A. Risk Factors.

Summary of Risk Factors

An investment in our common stock involves a high degree of risk. In determining whether to purchase our common stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this report before making a decision to purchase our securities. An investor should only purchase our securities if he or she can afford to suffer the loss of his or her entire investment.

Risks Related to Our Business

We have expressed substantial doubt about our ability to continue as a going concern.

As discussed in Note 1 to the consolidated financial statements for the fiscal year ended June 30, 2024, our consolidated financial statements for the fiscal year ended June 30, 2024 include an explanatory paragraph that such financial statements were prepared assuming that we will continue as a going concern. A going concern basis assumes that we will continue our operations for the foreseeable future and contemplates the realization of assets and the settlement of liabilities in the normal course of business.

We are in the clinical stage and have not generated any revenues to-date. For the fiscal year ended June 30, 2024, we reported a loss of approximately $8.5 million and a negative cash flow from operations of approximately $7.2 million. We had an accumulated

17

deficit of approximately $159.9 million and had cash and cash equivalents of approximately $4.9 million as of June 30, 2024. We do not have the prospect of achieving revenues until such time that our product candidates are commercialized, or partnered, which may not ever occur. In the near future, we will require additional funding to maintain our clinical studies, research and development projects, and for general operations. These circumstances indicate substantial doubt exists about our ability to continue as a going concern within one year from the date of filing of the consolidated financial statements.

Consequently, management is pursuing various financing alternatives to fund our operations so we can continue as a going concern. Management plans to secure the necessary financing through the issue of new equity and/or the entering into of strategic partnership arrangements in the event the Merger is not consummated. However, our ability to raise additional capital could be affected by various risks and uncertainties, including, but not limited to, global unrest. We may not be able to raise sufficient additional capital and may tailor our drug candidate development programs based on the amount of funding we are able to raise in the future. Nevertheless, there is no assurance that these initiatives will be successful.

The financial statements do not give effect to any adjustments to the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern. Such adjustments could be material.

We are a clinical stage company, have a history of operating losses, and expect to incur significant additional operating losses.

We are a clinical stage company with a history of operating losses. For the fiscal years ended June 30, 2024 and 2023, we had net losses of approximately $8.5 million and $14.6 million, respectively and an accumulated deficit of approximately $159.9 million at June 30, 2024. Our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in similar stages of operations. We expect to incur substantial additional net expenses and losses over the next several years as our research, development, clinical studies, and commercial activities increase.

The amount of future losses and when, if ever, we will achieve profitability are uncertain. Our ability to generate revenue and achieve profitability will depend on, among other things, successful completion of the preclinical and clinical development of our product candidates; obtaining necessary regulatory approvals from the FDA and international regulatory agencies; successful manufacturing, sales and marketing arrangements; and raising sufficient funds to finance our activities. If we are unsuccessful at some or all of these undertakings, our business, prospects and results of operations may be materially adversely affected.

We will need to raise additional capital, which may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to technologies or product candidates.

If the Merger is not consummated, or until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of public or private equity offerings, debt financings and/or license and development agreements with collaboration partners. As of June 30, 2024, we had cash and cash equivalents of approximately $4.9 million. We expect the cash available at June 30, 2024, and the potential cash received from research grant funding, to fund our planned operations for less than one year from the date of filing this report on Form 10-K. We will need to raise additional capital to fund our planned operations.

To the extent that we raise additional capital through the sale of other equity or convertible debt securities, then-existing stockholders’ interests may be materially diluted, and the terms of such securities could include liquidation or other preferences that adversely affect their rights as common stockholders. Debt financing and preferred equity financing, if available, may involve agreements that include restrictive covenants that limit our ability to take specified actions, such as incurring additional debt, making capital expenditures or declaring dividends. In addition, debt financing would result in fixed payment obligations.

If we raise funds through collaborations, strategic partnerships or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves. In addition, if the Merger is not consummated, we may not have sufficient capital to continue to operate our business in the long term and may become insolvent and be required to seek the protection of the bankruptcy courts and, without additional funding or a strategic transaction, we would likely be delisted from Nasdaq.

Our inability to obtain additional financing could adversely affect our ability to meet our obligations under our planned clinical studies and could negatively impact the timing of our clinical results.

Our ability to meet our obligations and continue the research and development of our product candidate is dependent on our ability to continue to raise adequate financing. We may not be successful in obtaining such additional financing in the amount required at any time, or for any period, or, if available, that it can be obtained on terms satisfactory to us. In the event that we are unable to

18

obtain such additional financing, we may be unable to meet our obligations under our planned clinical studies and we may have to tailor the drug development programs for our drug candidates based on the amount of funding we raise which could negatively impact the timing of our clinical results. In addition, we could be required to cease our operations.

We are not currently in compliance with the minimum bid price requirement for continued listing on The Nasdaq Capital Market. If we do not regain compliance and continue to meet the continued listing requirements, our common stock may be delisted from The Nasdaq Capital Market, which could affect the market price and liquidity for our common stock and reduce our ability to raise additional capital.

Our common stock is listed for trading on Nasdaq. We must satisfy Nasdaq’s continued listing requirements, including, among other things, a minimum closing bid price requirement of $1.00 per share (“Minimum Bid Price Requirement”) for 30 consecutive business days. On December 13, 2023, the Staff of the Listing Qualifications Department of The Nasdaq Stock Market LLC (the “Nasdaq Staff”) notified us that we did not comply with the Minimum Bid Price Requirement (the “Bid Price Notice”). Pursuant to the Bid Price Notice, we had 180 calendar days from the date of the Bid Price Notice, or June 10, 2024, to regain compliance for a minimum of ten consecutive business days. On June 12, 2024, the Nasdaq Staff notified us that we are eligible for and has been granted an extension of 180 calendar days, or until December 9, 2024, to regain compliance for a minimum of ten consecutive business days. On October 4, 2024, at the Special Meeting, our stockholders approved a reverse stock split of our common stock, to be effected in the board of directors’ discretion of not less than 1-for-20 and not more than 1-for-40. We intend to effect a reverse stock split at a ratio within the range approved by our stockholders immediately prior to the consummation of the proposed Merger.

We will continue to monitor our bid price and may, if appropriate, consider implementing available options to regain compliance with the Minimum Bid Price Requirement. There can be no assurance that we will be able to regain compliance with the Minimum Bid Price Requirement or maintain compliance even if we implement an option that regains our compliance.

If we fail to regain compliance with the Minimum Bid Price Requirement, or to meet the other applicable continued listing requirements for The Nasdaq Capital Market in the future, our common stock may be delisted and trade on the OTC Markets Group Inc. or other small trading markets, which could reduce the liquidity of our common stock materially and result in a corresponding material reduction in the price of our common stock as well as reduce our ability to raise additional capital. In addition, if our common stock is delisted from Nasdaq and the trading price remains below $5.00 per share, trading in our common stock might also become subject to the requirements of certain rules promulgated under the Exchange Act, which require additional disclosure by broker-dealers in connection with any trade involving a stock defined as a “penny stock” (generally, any equity security not listed on a national securities exchange or quoted on Nasdaq that has a market price of less than $5.00 per share, subject to certain exceptions). Such a delisting likely would impair your ability to sell or purchase our common stock when you wish to do so. Further, if we were to be delisted from Nasdaq, our common stock may no longer be recognized as a “covered security” and we would be subject to regulation in each state in which it offers securities. Thus, delisting from Nasdaq could adversely affect our ability to raise additional financing through the public or private sale of equity securities, would significantly impact the ability of investors to trade our securities and would negatively impact the value and liquidity of our common stock.

If we are unable to effectively maintain a system of internal control over financial reporting, we may not be able to accurately or timely report our financial results and our stock price could be adversely affected.

Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations require us to evaluate the effectiveness of our internal control over financial reporting as of the end of each fiscal year, and to include a management report assessing the effectiveness of our internal control over financial reporting in our Annual Report on Form 10-K for that fiscal year. Any failure to implement new or improved controls, or difficulties encountered in the implementation or operation of these controls, could harm our operations, decrease the reliability of our financial reporting, and cause us to fail to meet our financial reporting obligations, which could adversely affect our business and reduce our stock price.

We are a clinical stage company and may never achieve commercialization of our product candidates or profitability.

19